capital gain: How to calculate short-term and long-term capital gains and tax on these - The Economic Times

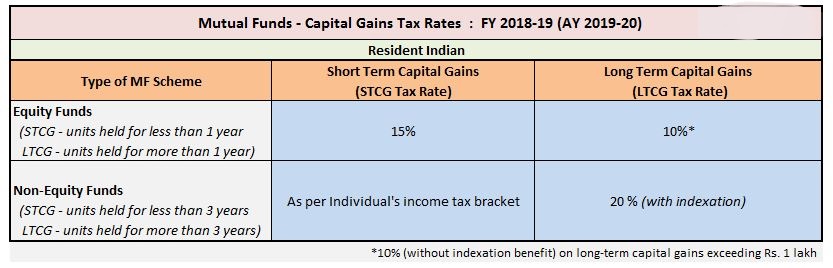

Initial public offerings, bonus and rights issues will be eligible for concessional rate of 10% long-term capital gains (LTCG) tax even if the Securities Transaction Tax (STT) has not been paid earlier.

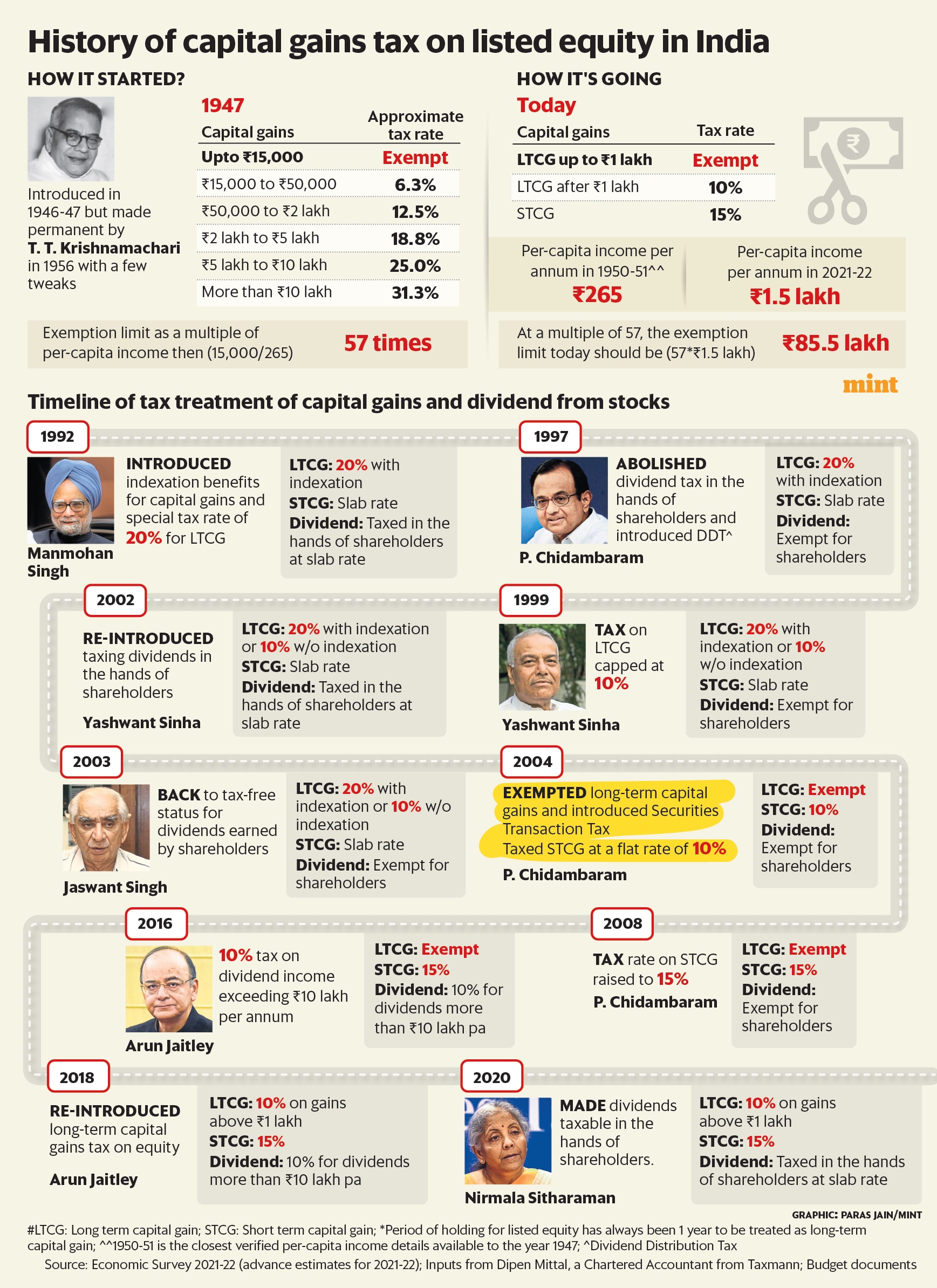

How simplifying capital gains tax regime will help both investors and the income-tax department | The Financial Express