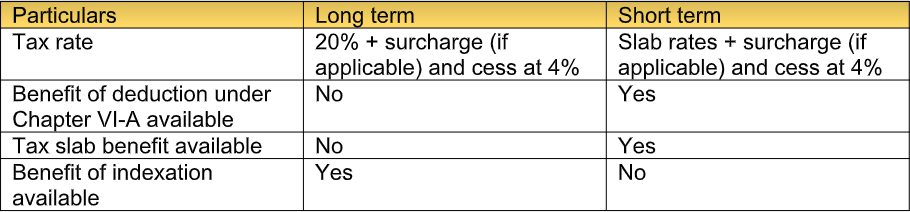

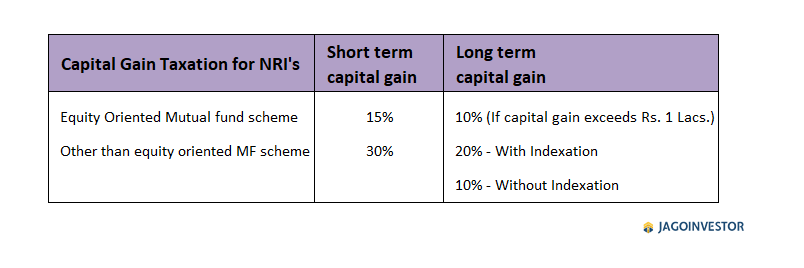

Is capital gain indexation allowable for NRI for long & short capital gain on a mutual fund? - Quora

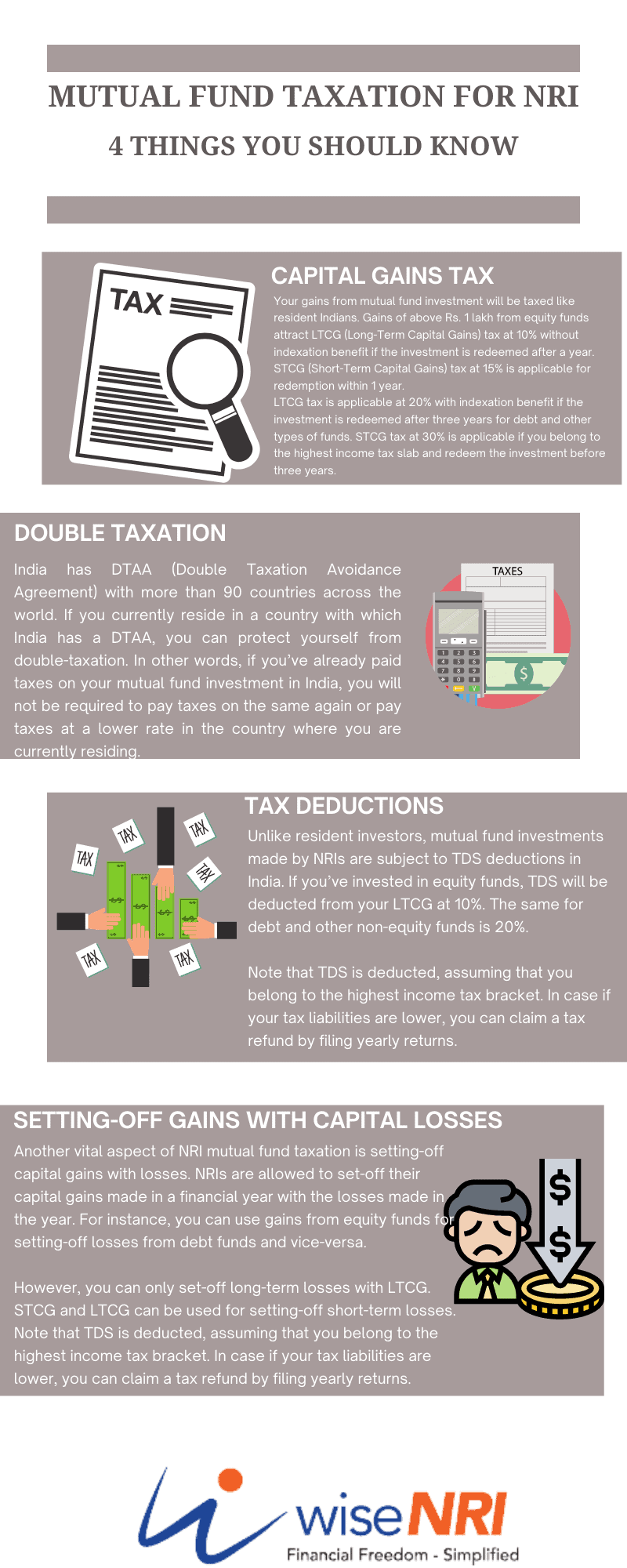

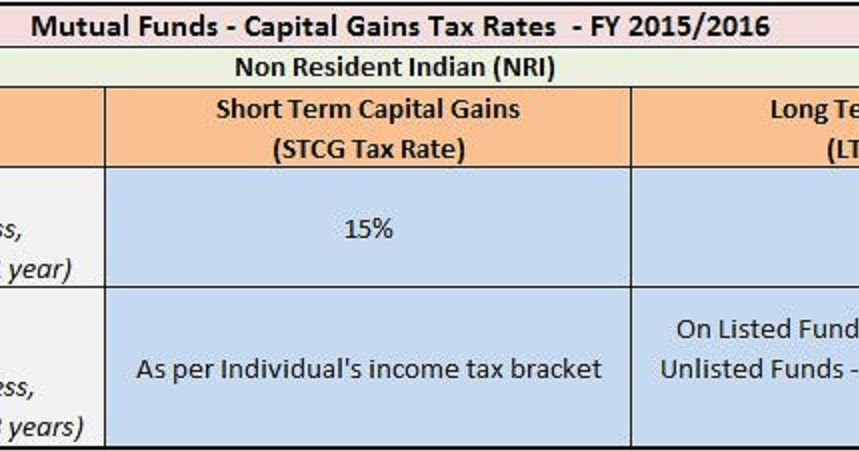

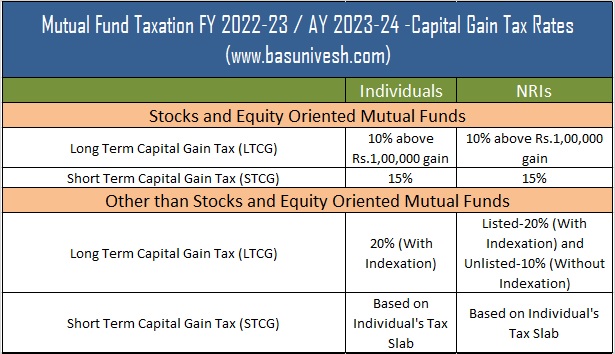

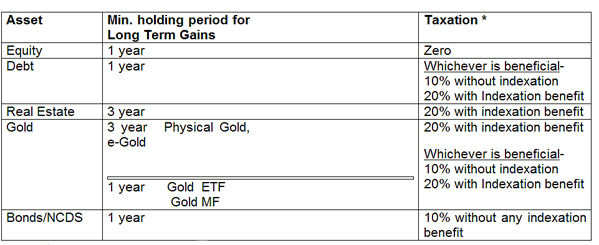

Mutual Funds Capital Gains Taxation Rules FY 2018-19 (AY 2019-20) | Capital Gains Tax Rates Chart for NRIs. | Mutuals funds, Capital gain, Fund

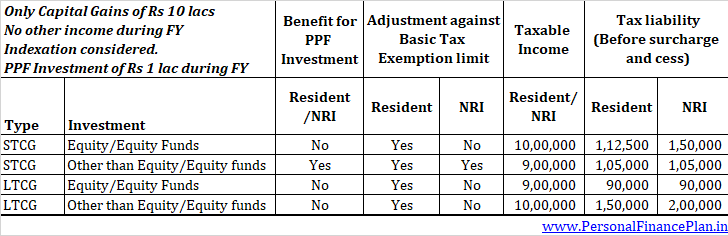

itr 2 nri | 115ad vs 112a | nri income tax| NRI capital gain tax | itr 2 filing online 2021-22 - YouTube

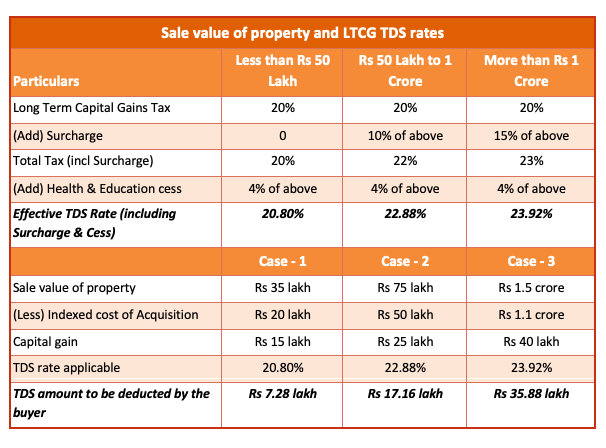

![TDS on Sale of Property by NRI in India [New Rates for 2023] - SBNRI TDS on Sale of Property by NRI in India [New Rates for 2023] - SBNRI](https://sbnri.com/blog/wp-content/uploads/2023/05/Exemption-on-Capital-Gain-Tax.png)