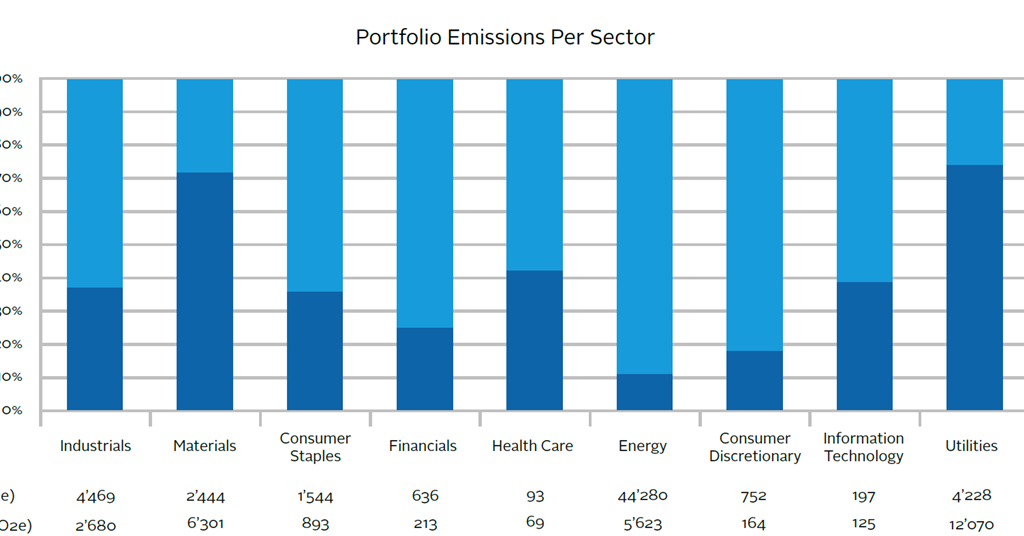

How measuring a portfolio carbon footprint can assist in climate risk mitigation and reducing emissions | Discussion paper | PRI

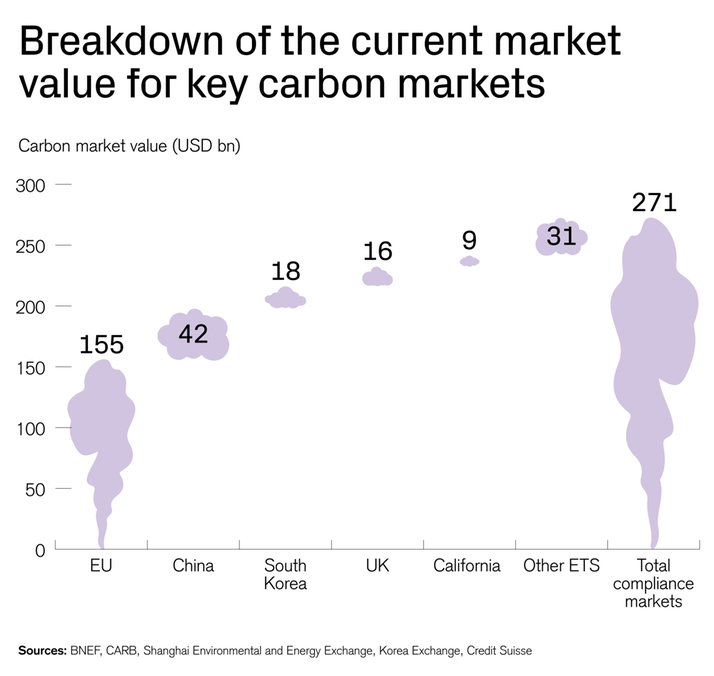

Carbon is an emerging asset class that could potentially rival the global oil market in size - Andrew McAuley | Livewire

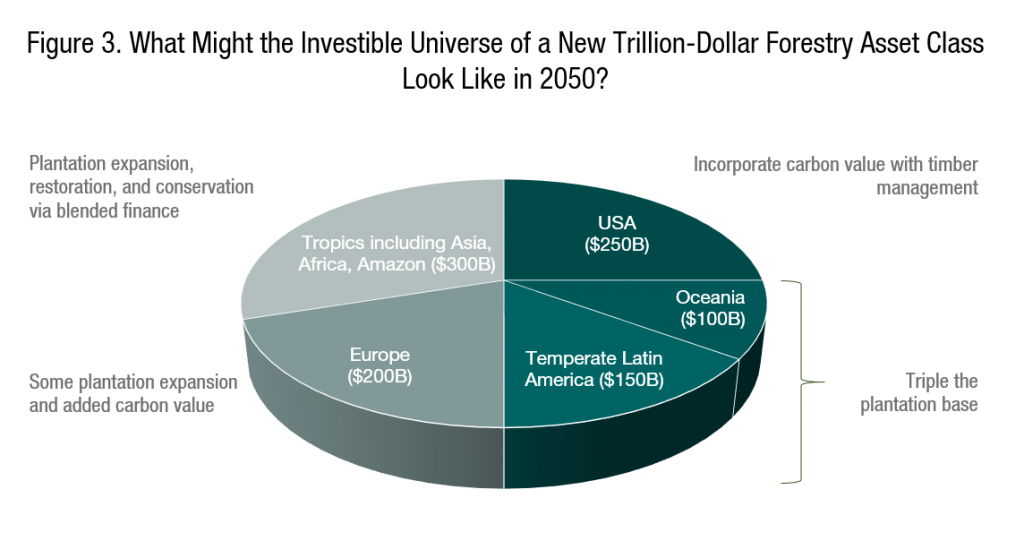

A Financial Architecture for Global Carbon Sinks: A New Forestry Investment Strategy - Ecosystem Marketplace

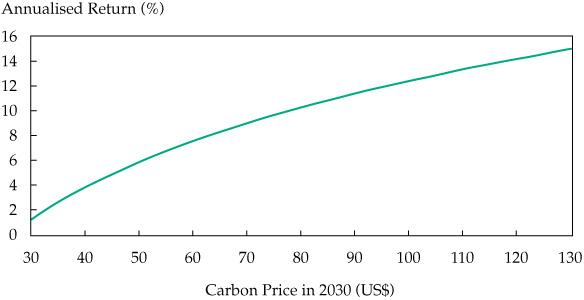

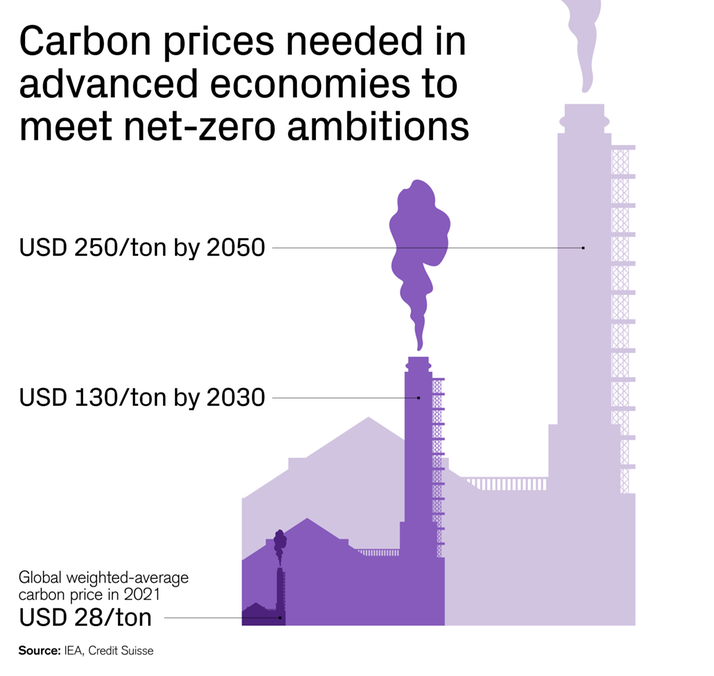

Carbon credits are set to become the most important new asset class for anyone worried about climate change.

Katusa Research on Twitter: "Carbon credits have outperformed all major asset classes over the past 3 years (outperforming #BTC. And the price of an emissions credit is up nearly 50% YTD. -@MarinKatusa

Carbon is an emerging asset class that could potentially rival the global oil market in size - Andrew McAuley | Livewire